Option Sentiment Data and Trading Strategies on Global Crisis on Cboe's New Trading Floor

Event Description: CTIA and Cboe Global Market would like to invite financial professionals to Cboe’s new trading floor in Chicago to experience the invigoration of open outcry. After the closing bell, two guest speakers, one from Cboe and one invited by CTIA, will share their latest insights about the options market and options trading strategies, on recent Global major events, respectively. After the seminars, a reception will be served to attendees, and networking will be more than welcomed.

Date: Wednesday, September 14th

In-Person ticket (beverage and snack incl.): $15 for CTIA member and $20 for non-CTIA member (limited to 20 people; First come first serve)

In-Person Location: Trading Floor, Cboe Global Markets, CBOT building, Chicago, IL

Online meeting ticket: Free for CTIA member and $5 for non-CTIA member

Trading Floor Tour Check-in End Time: 2:45 PM CT

Seminar/Webinar Start Time: 3:00 PM CT

Seminar Duration: 120 minutes

Networking Time: 5:30 PM – 6:30 PM CT

Event Schedule:

- 2:30 - 2:45 PM CT Trading Floor Check-in

o Meet at 2nd Floor, CBOT building, 141 W Jackson Blvd, Chicago, IL 60604

o We will take all the guests together to the trading, Cboe Global Markets

- 2:45 PM - 3:15 PM CT Trading Floor Tour

o Watch Market Close Bell Ringing

- 3:15 PM – 4:15 PM CT

o Title: “Option Sentiment Data”

o Speaker: Henry Schwartz, Vice President, Global Head of Client Engagement, Cboe Global Markets, Inc

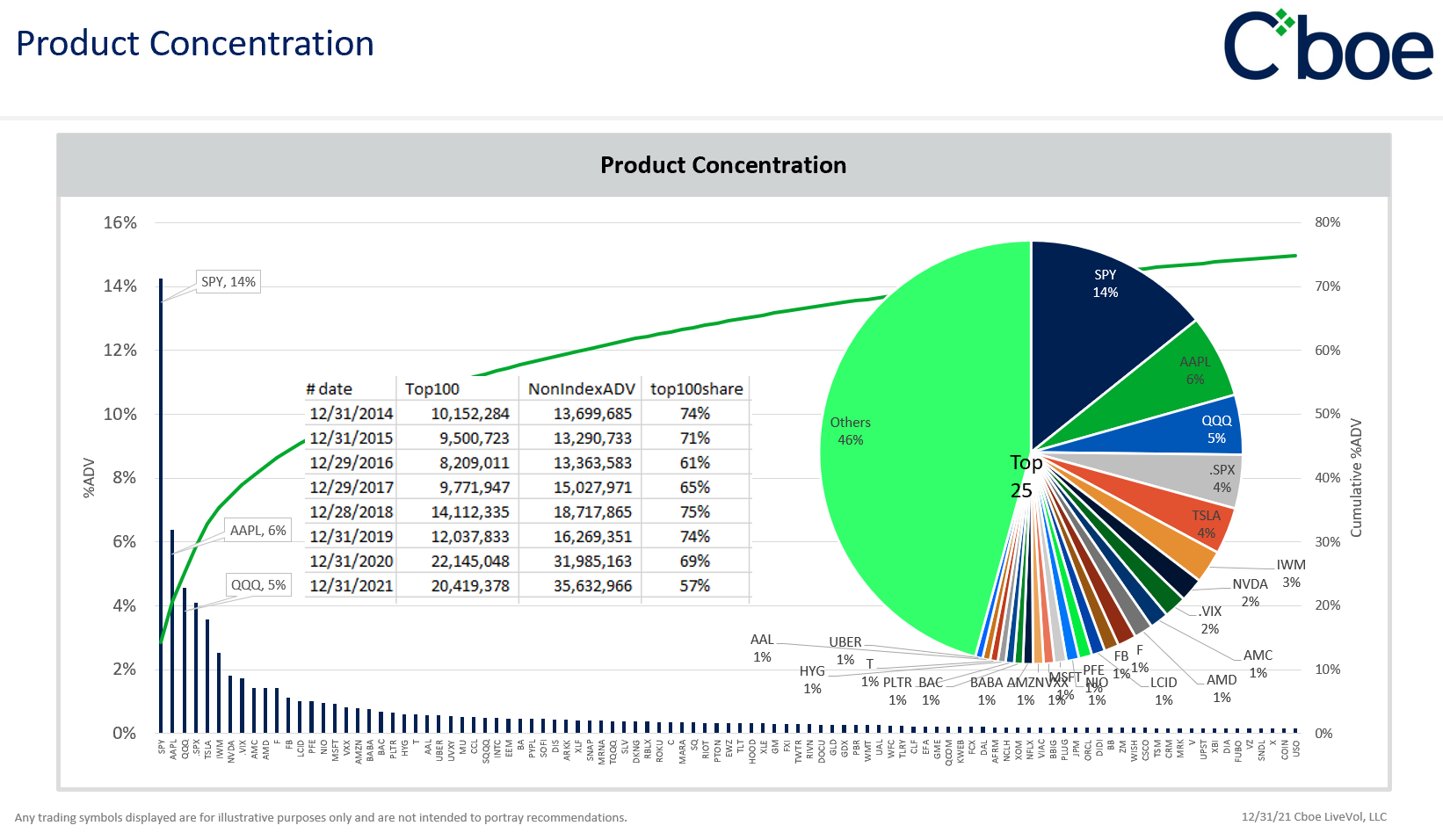

o Abstract: Mr. Schwartz will illustrate the trend of aggregated and retail options trading activities with both bird's-eye view and in-depth insight. He will also delve into product concentration by symbol and market share by fee type (i.e., PFOF or rebate, Maker-Taker, and Hybrid), which gives us some perspectives on the recent provoked topics.

- 4:25 PM – 5:25 PM CT

o Title: “Options Strategies on Global Crisis”

o Speaker: Jim W. Huang, CFA, Featured contributor to TradingView.com

o Abstract: Mr. Huang will discuss a proprietary 3-factor asset pricing model with a new crisis premium factor and previous strategies including gold options during the 2018 US-China Trade War and strangle options on wheat futures during the Russia-Ukraine War. He will also elaborate how to break down the US Midterm Elections into three outcome categories, how various assets would respond to them differently, and how to leverage the insight about Fed rate hikes and runaway inflation into profitable trades.

- 5:30 PM – 6:30 PM CT: In-person Reception outside of the conference room. Beverage and food will be served upon reservation.

About the speaker:

Henry Schwartz

Vice President, Global Head of Client Engagement

Cboe Global Markets (Cboe)

Schwartz joined Cboe in June 2020 as part of the company's acquisition of Trade Alert, which he co-founded after nearly 15 years in the industry.

In his role at Cboe, Schwartz coordinates the Client Engagement team, a group of experienced professionals responsible for the satisfaction and success of market participants using data-driven tools and services provided by Data and Access Solutions, including Risk and Market Analytics, Cboe Global Indices Feed and Cboe Global Indices.

Jim W. Huang, CFA

Market Consultant and Owner of Jules Verne Farm, IL

Featured contributor to TradingView.com

Mr. Huang has been devoted to the commodity and equity derivatives industry for more than 20 years. Mr. Huang was a director of Product Strategy at CME group before 2011. After that, he started his own business in China as the CEO of China-America Commodity Data Analytics, Inc. During the recent decade, he designed a market maker program for DCE Soybean Meal Options, China’s first options contract launched in March 2017. He is a CFA charter-holder and owns an MBA from Chicago Booth.

Selina Han

Economist, Cboe Global Markets (Cboe)

Vice President of CTIA Chicago

Selina has conducted quantitative research in corporate finance, applied economics, commodity, and equity derivatives for 12 years. started her role as a quantitative researcher and data scientist in Data and Access group at Cboe four years ago. That role focused on prototyping for options trading analytical tools and creating proprietary option data products. In Jan 2022, Selina was promoted to Economist at MPGA, delivering insight and research on market structure topics encompassing all asset classes in the U.S. and Europe - equities, options, ETPs, FX, and crypto.